venmo tax reporting for personal use

Venmo PayPal Cash App must report 600 in business transactions to IRS. If you need help to manage your Venmo 1099 expenses and taxes try Bonsai Tax.

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You News Wsiltv Com

Through 2021 the law required third-party settlement providers to report to the IRS any user who received at least 200 commercial transactions totaling at least 20000.

/how-safe-venmo-and-why-it-free_FINAL-d6b7c0672d534208a05d1d53ae0cd915.png)

. Users typically save 5600. Zelle rhymes with sell is a peer-to-peer or person-to-person app that enables you to send money quickly from your bank account to. Venmo is a payment processor made by PayPal for personal financial transactions.

However if youve already co-mingled business and personal transactions in one account make sure you keep detailed records of your business revenues and report the correct amount to the IRS regardless of what your. Updated 316 PM ET Mon January 31 2022. If you use PayPal Venmo or other P2P platforms for business save time with effortless expense tracking year-round with QuickBooks Self-Employed which can easily import expenses into TurboTax Self-Employed during tax time.

Just Fill Out Your Info Including Your Mobile Number Get 10 When You Sign Up For Venmo. Venmo Tax Reporting For Personal Use Does Venmo Report To Irs. You should get a 1099-NEC for 800 from Client A and a 1099-K reporting the 700 from Venmo.

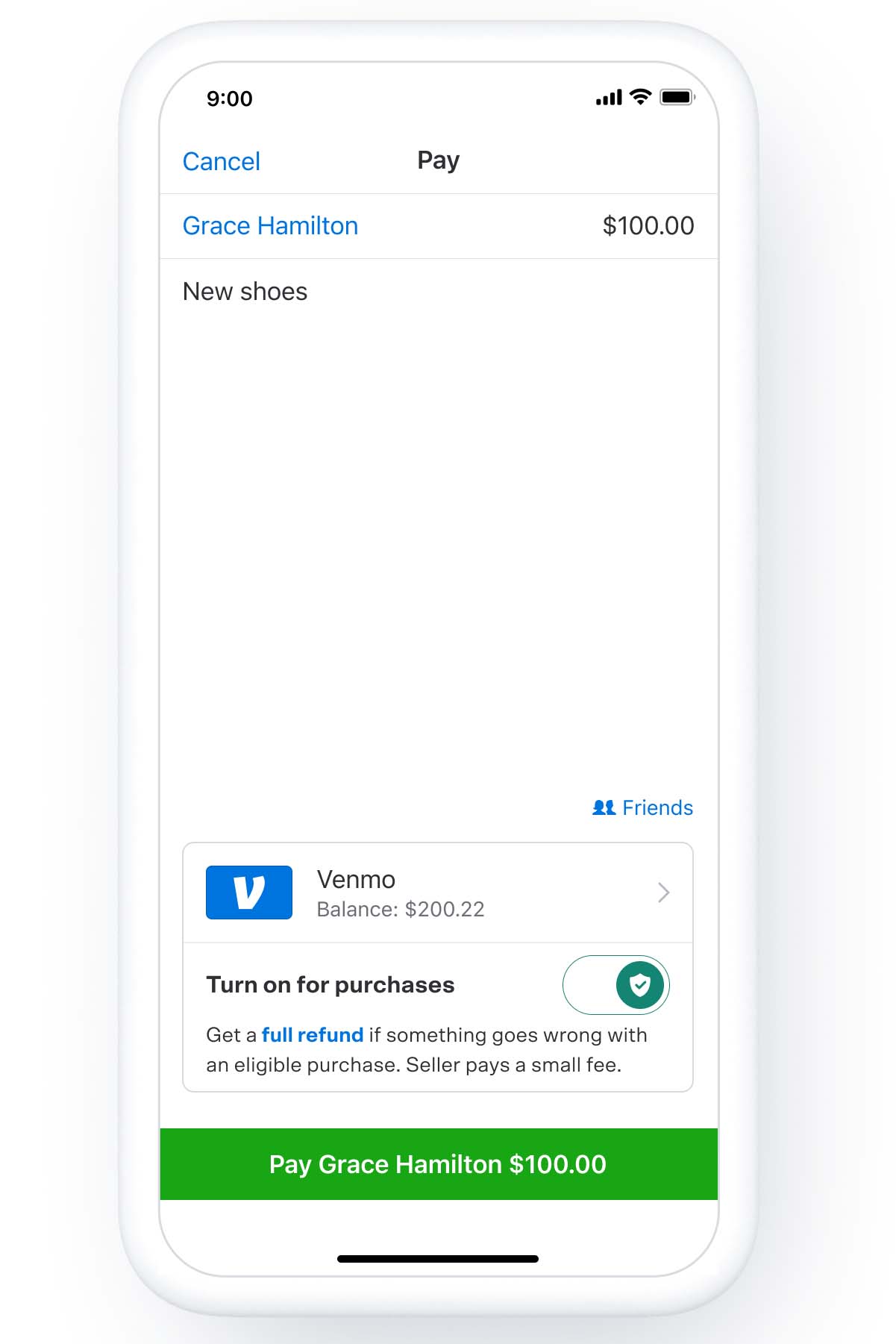

It allows you to easily split rent with your roommate send. Article continues below advertisement. For the 2021 tax year Venmo will issue a Form 1099-K to business profile owners who have passed the IRS reporting threshold for their state of residence.

Rather small business owners independent contractors and those with a. Businesses are still required to report any payments received through Venmo and PayPal as taxable income when filing taxes. Keep track of your Venmo PayPal and other payment app transactions in case the IRS comes asking You are going to have to report revenue on goods and services of more than 600 a year By Michelle.

In this guide well be exploring Venmo 1099 taxes. Prior to this change app providers only had to send the IRS a Form 1099. Anyone who receives at least 600 in payments for goods and services through Venmo or any other payment app can expect to receive a Form 1099-K.

Prior to this legislation third-party payment platforms would only report to the tax agency if a user had more than 200 commercial transactions and made more than 20000 in payments over the. If you use payment apps like Venmo PayPal or CashApp the new year ushered in a change to an IRS tax reporting rule that could apply to some of your transactions. For example when you go out to a restaurant with friends and family and wish to split the bill between yourselves.

The new reporting requirement only applies to sellers of goods and services not. Many people use Venmo strictly for personal transactions the company reports that the average payment amount is 60. The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600.

Currently online sellers only received these forms if they had at least. Previously the threshold was 20000 in income and 200 or more. Under the American Rescue Plan Act people who sell goods or services on platforms like Etsy eBay and other sites that use third-party transaction networks like PayPal Cash App and Venmo will be issued a tax form called a 1099-K for online sales totaling 600 or more starting next year.

If you use payment apps like Venmo PayPal or CashApp the new year ushered in a change to an IRS tax reporting rule that could apply to some of your. Registration is a piece of cake and you can use your contacts or email addresses to find your friends. Just Fill Out Your Info Mobile Number.

The app is simply a digital wallet connecting to your payment methods. Ad Get 10 When You Sign Up For Venmo. A business transaction is defined as payment for a good or service.

The best way to avoid having personal transactions reported to the IRS is to use separate Venmo accounts for personal and business transactions. Due to lower federal IRS reporting thresholds for 2022 you may need to provide Venmo with your tax information if youre receiving payments for sales of goods and services. While Venmo is required to send this form to qualifying users its worth.

To help ensure compliance with new federal regulations payments received for sales of goods and services in excess of federal or state reporting thresholds will be placed on hold until your tax information. Well explain how to handle Venmo transactions and the taxes you need to be aware of. These kinds of personal transactions dont need to be reported on your tax return and are perfect for Venmo.

Venmo and other payment services will have to report 600 or more in payments to the IRS and provide you with a 1099-K for the year 2022. The Internal Revenue Service is cracking down on people who underreport earnings received through digital payment apps such as PayPal Venmo Cash App Zelle and others. Starting the 2022 tax year the IRS will require reporting of payment transactions for goods and services sold that meets or exceeds 600 in a calendar year.

The tax-reporting change only applies to charges for commercial goods or services not personal charges to friends and. For most states the threshold is 20000 USD in gross payment volume from sales of goods or services in a single year AND 200 payments for goods and services in the same year. This new tax rule only applies to payments for goods and services not for personal payments between friends and family.

But CNBC says No the IRS isnt taxing your Venmo transactions It says a new law that took effect January 1st applies to small businesses to. Those posts refer to a provision in the American Rescue Plan Act which went into effect on January 1 2022 according to which anyone receiving 600 per year using Venmo PayPal Zelle or Cash App will receive a 1099-K and be required to report that income on their taxes. Our software will scan your bankcredit card receipts to discover tax write-offs automatically.

/how-safe-venmo-and-why-it-free_FINAL-d6b7c0672d534208a05d1d53ae0cd915.png)

What Is Venmo Are There Any Fees And Is It Safe

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

If You Use Venmo Paypal Or Other Payment Apps This Tax Change May Affect You In 2022

Afraid The Irs Will Tax Your Venmo Paypal Or Other Payment App Transactions Here S What You Should Do The Washington Post

Individual Tax Preparation Checklist Online Taxes Tax Preparation Tax Preparation Services

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

How To Stop Your Teenager Being Charged By The Irs For Sending Money To Their Friends On Venmo And Paypal

If You Re Using Venmo For Your Side Hustles Here S What You Need To Know About Taxes

How To Handle Your Taxes When You Re Paid Through Venmo Paypal And Others Gobankingrates

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

New Venmo Paypal Tax Reporting Rules What You Need To Know Hourly Inc

Venmo Cash App And Others To Report Payments Of 600 Or More In 2022 Earn Money From Home Money From Home Make Business

Tax Law Changes Could Affect Paypal Venmo And Cash App Users

New Tax Rule Ensure Your Venmo Transactions Aren T Accidentally Taxed Gobankingrates

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

New Tax Rule Requires Money Apps To Report Transactions Totaling More Than 600 Year Ktalnews Com

What To Know About The Irs New Reporting Requirements For Venmo Paypal And Other Payment Apps

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You News Wthitv Com